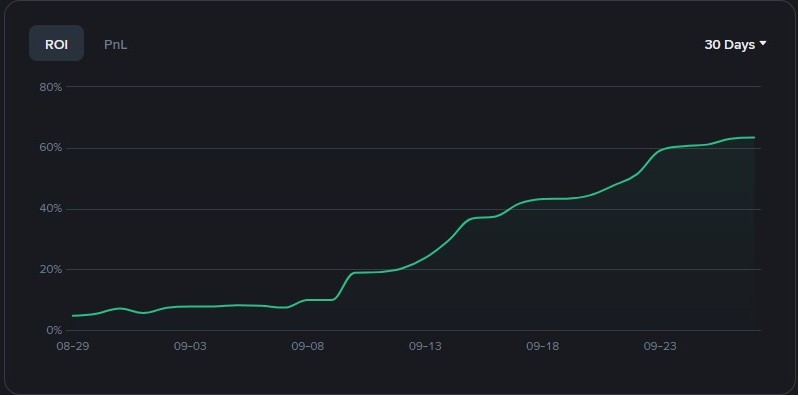

At FXCryptoBots, we believe results speak louder than promises. That’s why our team carried out a small account demonstration to showcase how powerful the Frog metric and our custom alerts can be in live trading.

We chose a small account to prove that our approach is accessible to any trader and to highlight how the same tools can deliver meaningful performance for those who need consistent results. The goal was not just profit, but consistency, discipline, and risk management.

These were real trades, not backtests. Each entry was guided by our Frog volatility metric and delivered via real-time alerts.

The Frog metric measures volatility pressure and directional bias, helping identify assets that move faster. Since trading costs remain constant regardless of volatility, it’s easier to offset costs and generate profits with highly volatile assets. Combined with our alert system, Frog keeps traders focused on high-probability setups across Binance Futures markets.

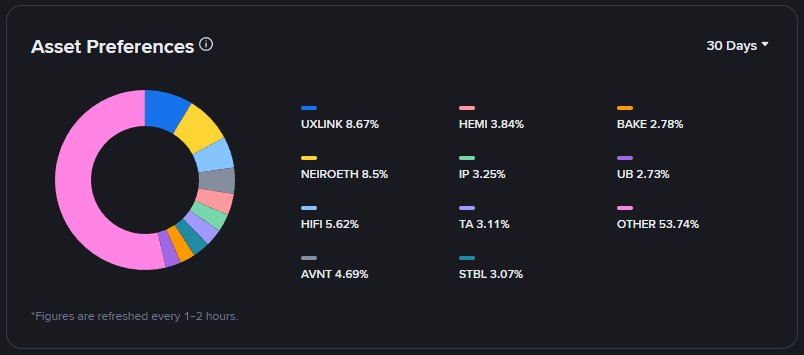

Another important aspect of this demonstration was the use of dozens of different trading pairs. Instead of relying on one or two lucky trades, the performance was built on a broad base of assets — showing that the Frog metric and alerts can be applied consistently across the market.

The chart below shows the distribution of assets traded during the demonstration period:

This small account demonstration proves that even modest capital can achieve meaningful results when paired with the right tools and discipline.

👉 Explore our Binance Futures Rankings and Alerts to see how you can put Frog to work in your own trading.