How Can Bitcoin and NASDAQ-100 Make New Highs Despite the Fed's Balance Sheet Decline?

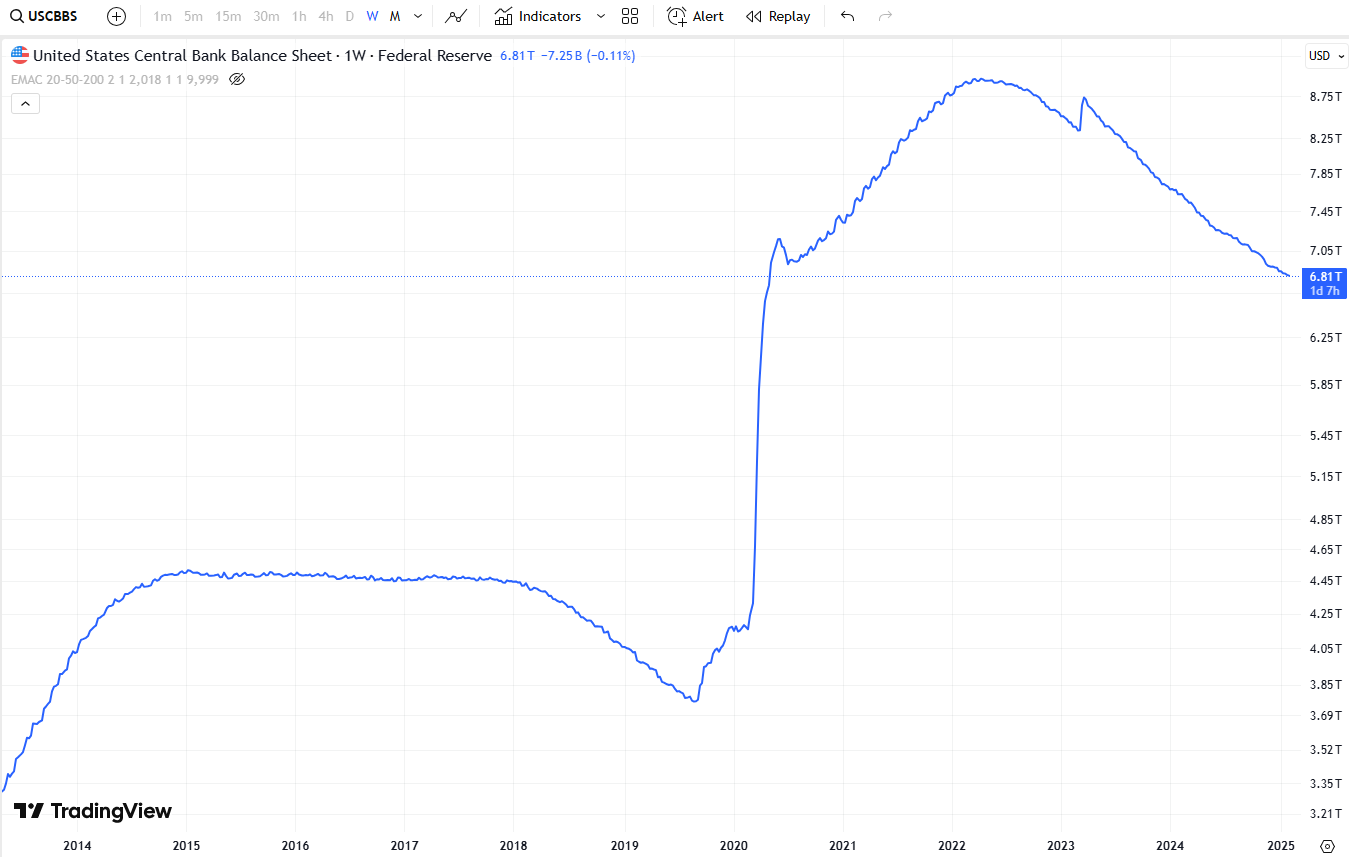

Chart from TradingView showing The Federal Reserve's balance sheet (Ticker: USCBBS)

This presents an intriguing paradox:

- The Federal Reserve's balance sheet is shrinking due to quantitative tightening (QT).

- Risk assets like Bitcoin and NASDAQ-100 are reaching new all-time highs.

Historically, asset prices have been positively correlated with liquidity injections (quantitative easing, QE) and negatively correlated with liquidity tightening (QT). This makes the current rally counterintuitive.

However, several key factors are fueling the market’s rise. Let’s break them down:

1️⃣ The Market is Forward-Looking (Anticipating Rate Cuts)

- The market has been pricing in rate cuts for 2025 despite the Fed’s earlier stance of keeping rates "higher for longer."

- In December 2024, the Federal Reserve signaled potential rate cuts for 2025, reinforcing bullish sentiment.

- Lower interest rates reduce borrowing costs, boosting valuations for stocks and crypto.

- Bond yields have started to decline in anticipation of looser monetary policy, making equities more attractive.

2️⃣ AI & Tech Boom is Driving NASDAQ Higher

- NASDAQ-100 remains heavily concentrated in AI-driven companies like Nvidia (NVDA), Microsoft (MSFT), Amazon (AMZN), and Meta (META).

- Despite high interest rates in 2024, investors viewed AI as a transformative technology that would drive long-term economic growth.

- AI adoption has led to strong earnings reports, further supporting NASDAQ valuations.

- Tech companies are benefiting from efficiency gains and automation, offsetting higher labor costs.

3️⃣ Bitcoin's Unique Drivers

📌 3.1. Bitcoin ETF Approval (Institutional Adoption)

- Spot Bitcoin ETFs were approved in January 2024, allowing institutions to invest in BTC through regulated channels.

- Major financial firms like BlackRock, Fidelity, and Grayscale launched Bitcoin ETFs, leading to billions in inflows throughout 2024.

- Institutional adoption increased Bitcoin’s legitimacy and reduced volatility over time.

📌 3.2. Bitcoin Halving Cycle (April 2024)

- The most recent Bitcoin halving took place in April 2024, reducing miner rewards from 6.25 BTC to 3.125 BTC per block.

- Historically, Bitcoin halvings have triggered major bull markets within 6-12 months due to reduced new supply.

- Many investors front-ran the supply shock, which contributed to Bitcoin's rally in late 2024 and early 2025.

📌 3.3. BTC as a Hedge Against Inflation & QE Expectations

- Despite QT, investors believe future economic slowdowns will force central banks to resume QE.

- Bitcoin is increasingly seen as "digital gold" and a hedge against fiat devaluation.

- Major institutional players like MicroStrategy continue accumulating BTC, reinforcing its store-of-value narrative.

4️⃣ Global Liquidity is Still Strong (Despite Fed QT)

- China is actively injecting liquidity into its economy to counteract slowing growth.

- Japan maintains ultra-low interest rates and continues yield curve control, sustaining global risk appetite.

- The European Central Bank (ECB) signaled policy easing in early 2025 as European economies faced recession risks.

- Liquidity from non-U.S. central banks is partially offsetting the Federal Reserve's tightening.

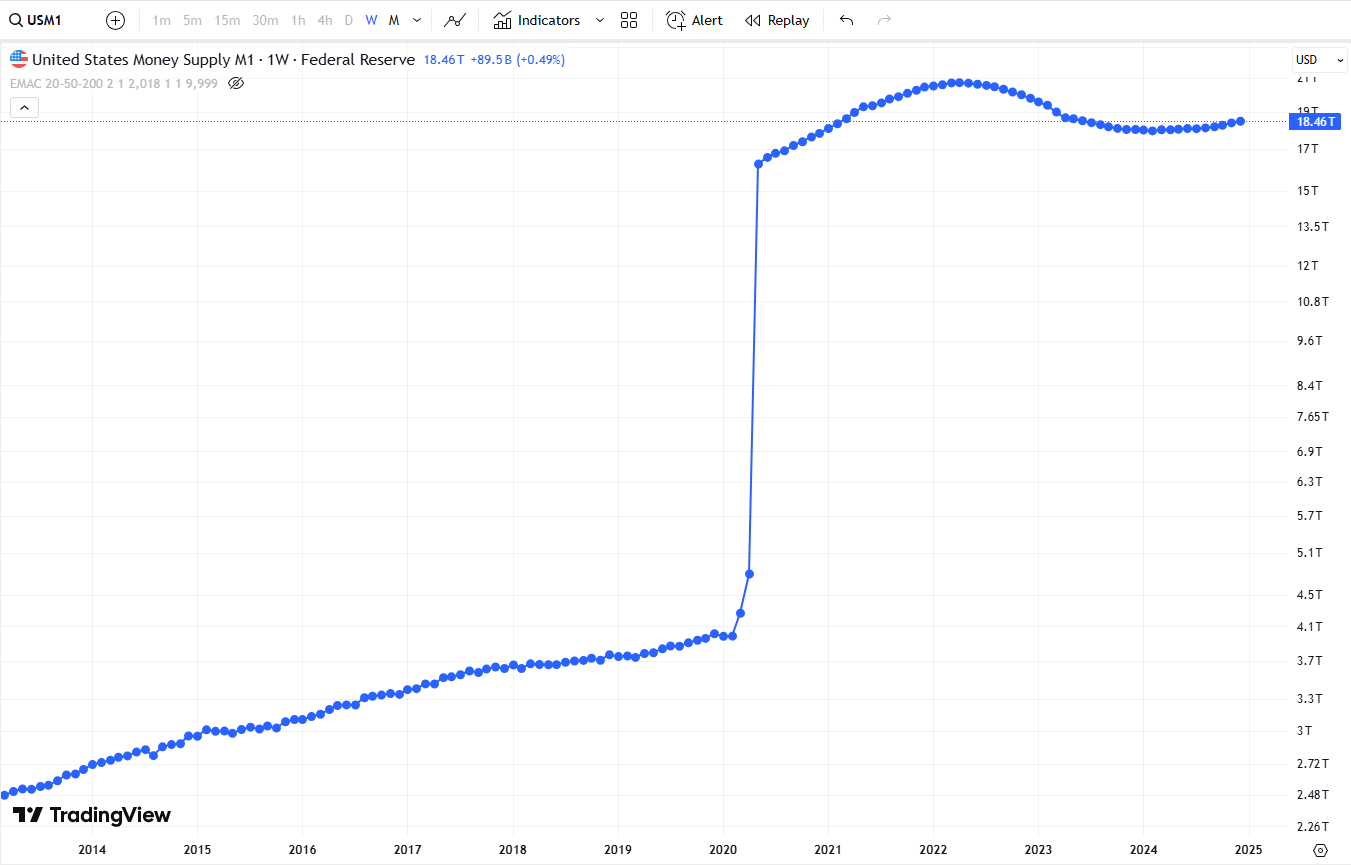

5️⃣ Elevated M1 Money Supply is Supporting Risk Assets

- M1 Money Supply remains historically high (~$18.46T as of early 2025).

- Despite the Fed's quantitative tightening, a large amount of liquid money is still circulating in the system.

- High M1 means **investors still have spending power**, which supports speculative assets like Bitcoin and tech stocks.

- If M1 starts declining sharply, it could signal **lower liquidity and a potential correction** in risk assets.

Chart from TradingView showing The US money supply M1 (Ticker: USM1)

6️⃣ Financial Engineering & Stock Buybacks

- Large corporations continue aggressive stock buyback programs, reducing available shares and supporting stock prices.

- Apple, Microsoft, and Meta announced multi-billion-dollar buybacks in late 2024, keeping their stocks resilient.

- Passive investing via index funds and ETFs is driving additional demand for large-cap tech stocks.

🔎 Conclusion: Why Are BTC & NASDAQ Hitting New Highs?

- Markets are forward-looking → Rate cuts expected in 2025.

- AI & tech boom → Strong earnings & momentum driving NASDAQ higher.

- Bitcoin ETF inflows + halving cycle → Strong demand & limited supply.

- Global liquidity is still high → China, Japan, ECB are offsetting Fed QT.

- Elevated M1 money supply → More liquidity still available for risk assets.

- Stock buybacks and passive investing → Supporting stock prices.

🚀 What Would Change This Bull Trend?

- 🔻 If inflation reaccelerates, the Fed might delay rate cuts → Risk assets could correct.

- 🔻 If corporate earnings disappoint, AI stocks could crash, dragging NASDAQ lower.

- 🔻 If BTC ETF inflows slow down, Bitcoin momentum could stall.

- 🔻 If M1 starts declining significantly, liquidity could dry up, impacting markets.

- 🔻 If geopolitical risks escalate (e.g., U.S.-China tensions, war risks), market sentiment could shift.

🔥 Final Thought:

The current rally is driven more by expectations of future monetary easing rather than the Fed’s present policy stance.

If the Federal Reserve follows through with rate cuts and stimulus in 2025, BTC and NASDAQ-100 could see even higher valuations.